.jpg)

Outdated technology limits growth in alternative asset fundraising

Accurate and timely data is crucial for institutional investors to make informed decisions about their alternative asset allocations. The challenges traditionally associated with sharing and collecting this information can significantly impact how asset managers, their investors and channel partners navigate the fundraising process.Currently, these groups spend hundreds of hours each month manually entering data into non-standard Excel templates, PDF documents and investment databases. This resource-intensive process involves multiple parties and systems, which can inadvertently lead to redundancies and inefficiencies.

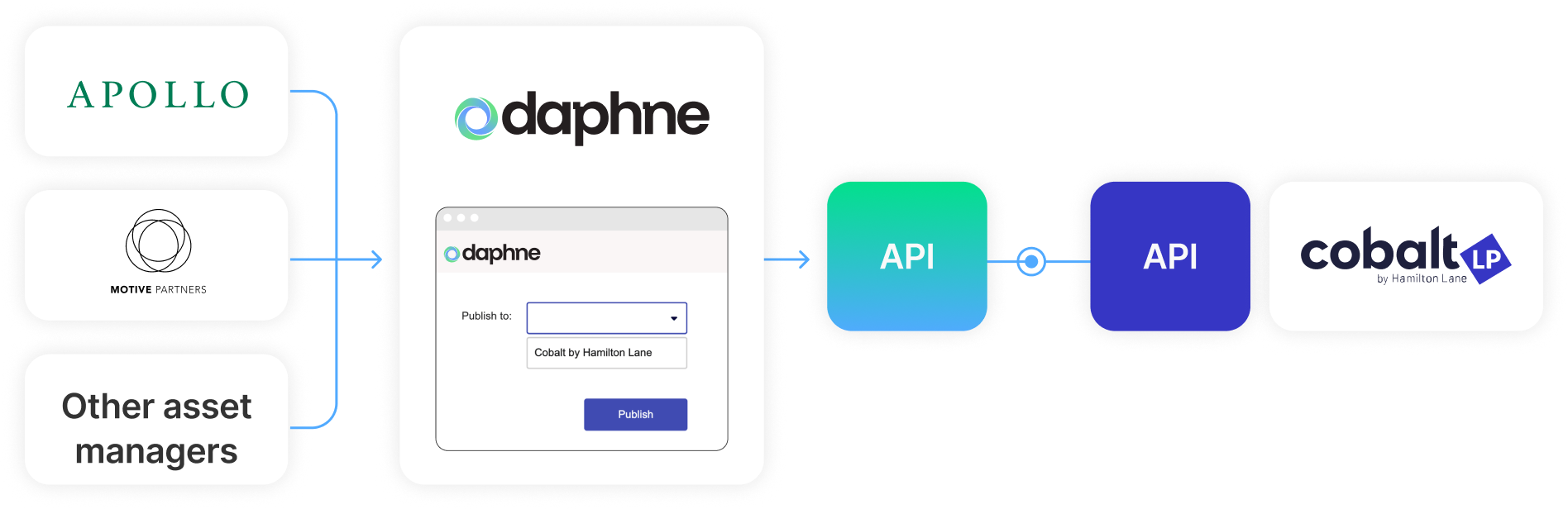

How Cobalt uses Daphne

Hamilton Lane’s Cobalt technology is leveraged by institutional investors worldwide and exemplifies the firm’s commitment to developing a leading technology ecosystem for its teams and clients. Today, Cobalt features one of the largest comprehensive databases in the private markets industry.Cobalt has designated Daphne as its preferred method for receiving data related to new fund offerings. This pre-investment integration streamlines the fund data entry and publication processing while allowing General Partners (GPs) to maintain control over their data and client experience. Using Daphne’s structured data model, GPs can provide Hamilton Lane’s investment teams and clients with consistently structured, up-to-date and automated digital fund information, supporting diligence processes, portfolio construction tools and client communications systems.

- Daphne digitizes a GP’s funds using Daphne’s Fund Master, a centralized and standardized data model that serves as a single source of truth for fund information, capturing performance metrics and other critical data.

- Once digitized, GPs can effortlessly publish fund data to Hamilton Lane’s Cobalt and other channels, including investment consultants, institutional LPs, independent broker dealers (IBDs), wirehouses and registered investment advisors (RIAs).

- Fund data stored in Daphne’s Fund Master can be transmitted and accessed via a web-based interface or API, ensuring data remains current at all times.

- Once Cobalt receives fund data from GPs, it becomes available within the platform immediately to assist Hamilton Lane’s Investment Team and clients with pre-investment diligence and selection.

Daphne allows GPs to implement a scalable distribution solution that maintains control over their brand, client experience and data while effortlessly expanding to additional distribution partners and LPs.

The advantages of using Daphne for GPs, beyond publishing to Cobalt

Deliver a superior fund marketing and distribution experience for channel partners and LPs

- Use a scalable distribution solution that maintains control over brand, client experience, and data while expanding to additional partners and LPs with a single click.

Accelerate time to market, eliminating months of manual effort per fund annually inputting product updates and reporting

- Gain control over fund information with direct, accurate updates to partners and LPs, eliminating risks from email communication and re-keying errors.

Scale your business without adding extra operational burden:

- Eliminate over 90-days of manual effort annually per fund inputting product updates and reporting.

- Automatically update documents using Daphne’s document automation tool, reducing update times on high-frequency documents from days to seconds.

The impact

- Using Daphne to send data to Cobalt and other LPs / channel partners saves these firms hours of manual work per week while removing the potential for inefficiencies and ensuring that databases are updated with the latest fund data.

- Over 60 private markets funds are actively digitized using Daphne’s platform across four GPs, helping raise more than $600 million in assets.